estate tax changes build back better

Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million.

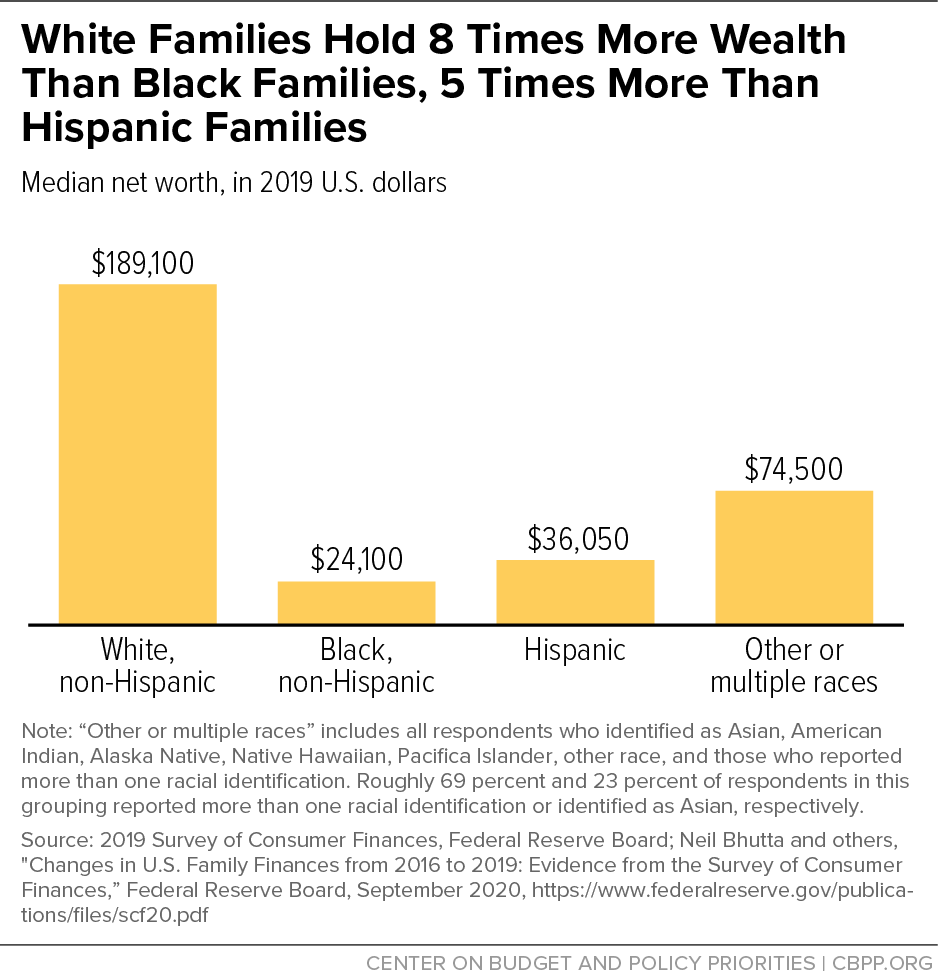

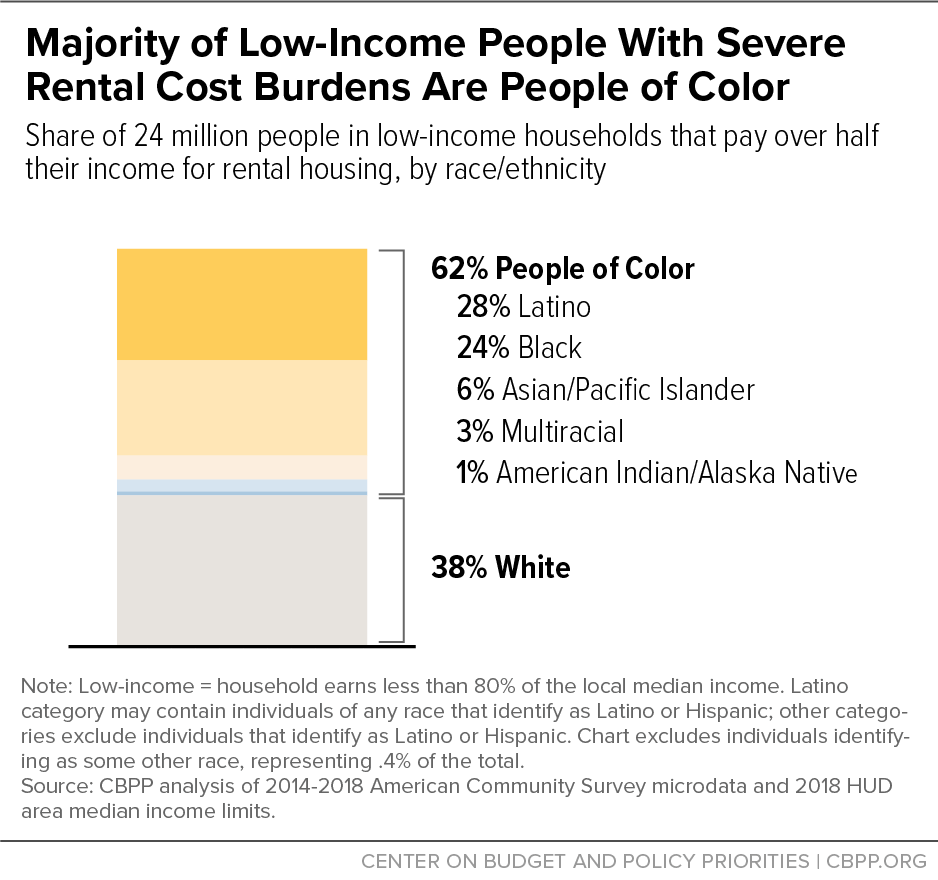

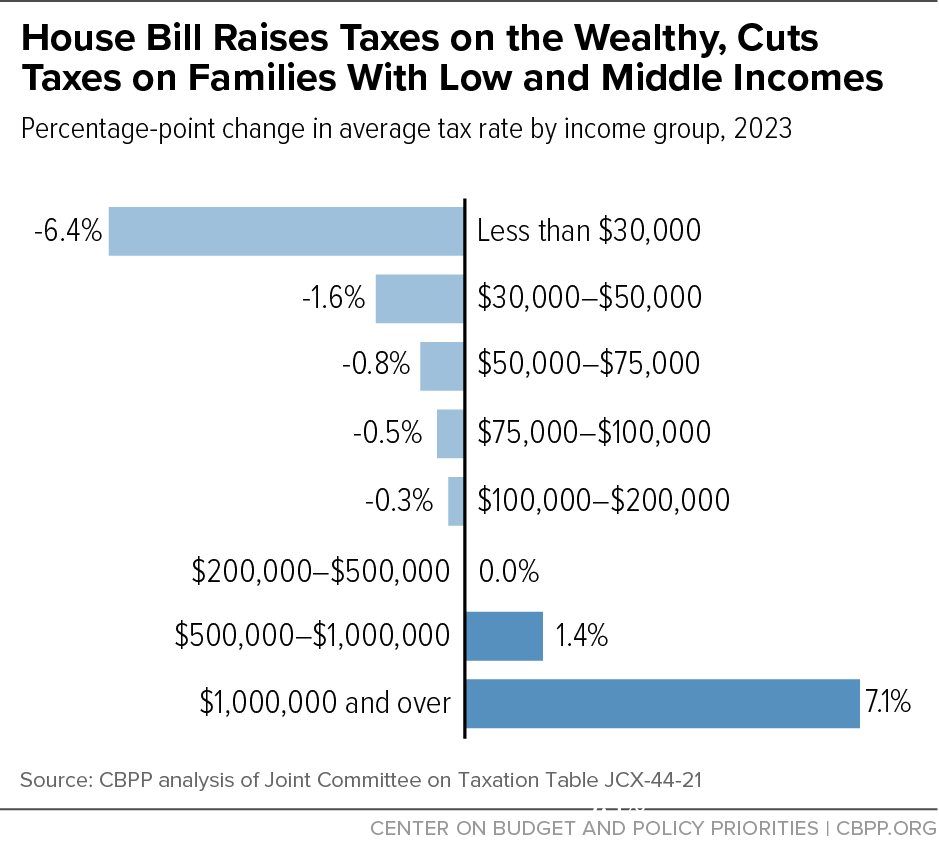

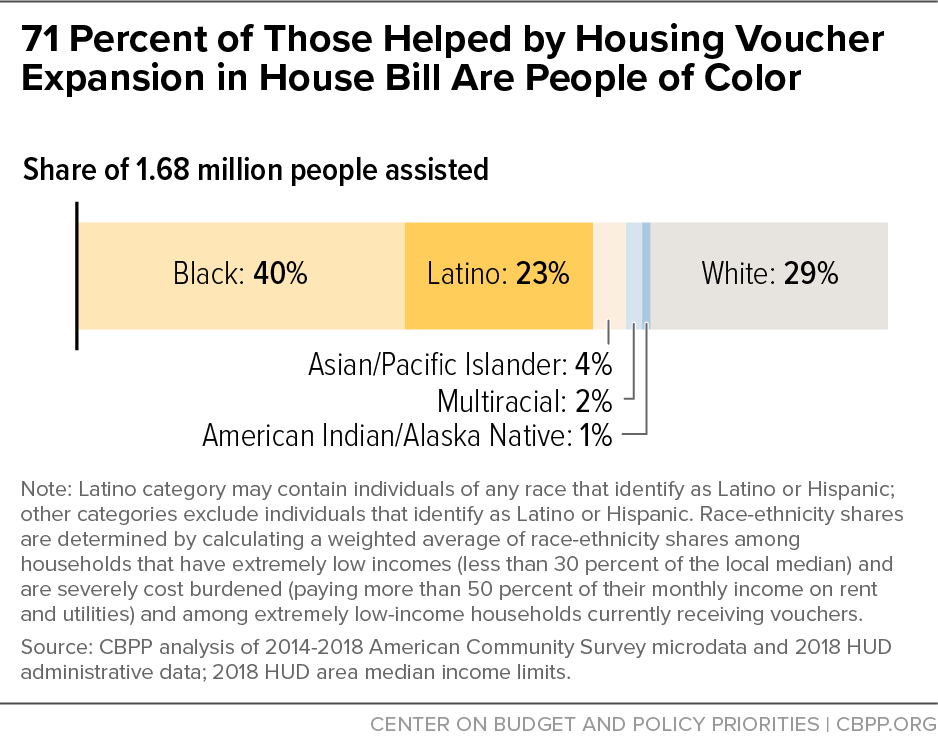

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

For decedents dying in 2021 this.

. The federal estate tax exemption is currently set at 10 million and is indexed for inflation. Our tax expert weighs in. 5376 would revise the estate and gift tax and treatment of trusts.

As a result the gift estate and GST tax exemptions are each 117 million per person in 2021. Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in. Lowering the gift and estate tax exemptions seems a lock.

The upshot is to avoid these new grantor trust tax rules create and fully fund your grantor trust by the end of 2021. Under the TCJA the exemption is scheduled to decrease to 5 million adjusted. The three major categories to quickly address are the lower gift and estate tax exemptions.

The BBBA proposal seeks to reduce these. In late October the House Rules Committee released a revised. Gift and Estate Taxes Proposed Under the Build Back Better Act.

30 sunset of the Employee Retention Credit ERC. The proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan. Revised Build Back Better Bill Excludes Major Estate Tax Proposals.

28 2021 President Joe Biden announced a framework for changes to the US. Lowering the gift and estate tax exemptions seems a lock. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA.

The CBO estimates the bill will cost almost 17 trillion and add 367 billion to the federal deficit over 10 years. There are very few tax provisions in the act. These proposals are currently under.

Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law. On September 13 2021 the House Ways and Means Committee released a proposed tax bill House proposal as part of the Biden administrations Build Back Better Act The segments. A notable exception is the early Sept.

The estate planning community got some very good news on October 28 2021 when the Biden administration released its Framework for the Build Back Better Act. Understand the different types of trusts and what that means for your investments. The AICPA told Congress about our concerns with the.

Proposed Reduction in Federal Estate Tax Exemption Amount. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117. Adding in 207 billion of nonscored revenue that is estimated to.

Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan. Understanding Other Proposed Changes Under the Build Back. Understanding Other Proposed Changes Under the Build Back Better Act.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

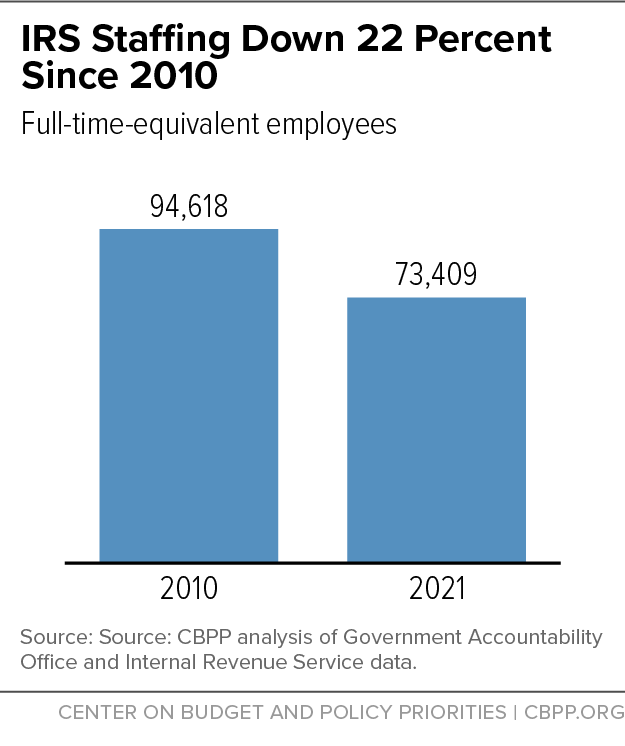

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

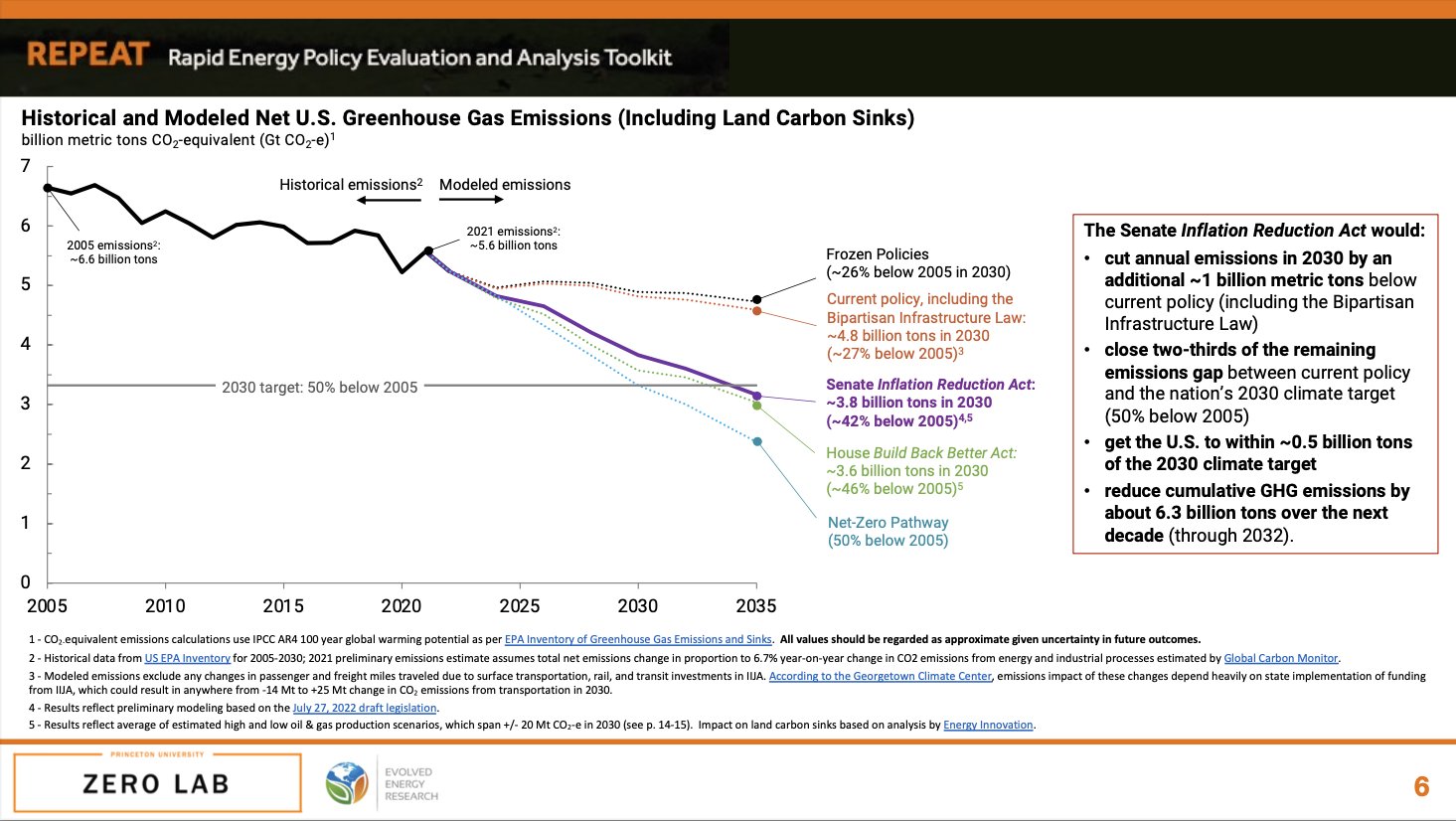

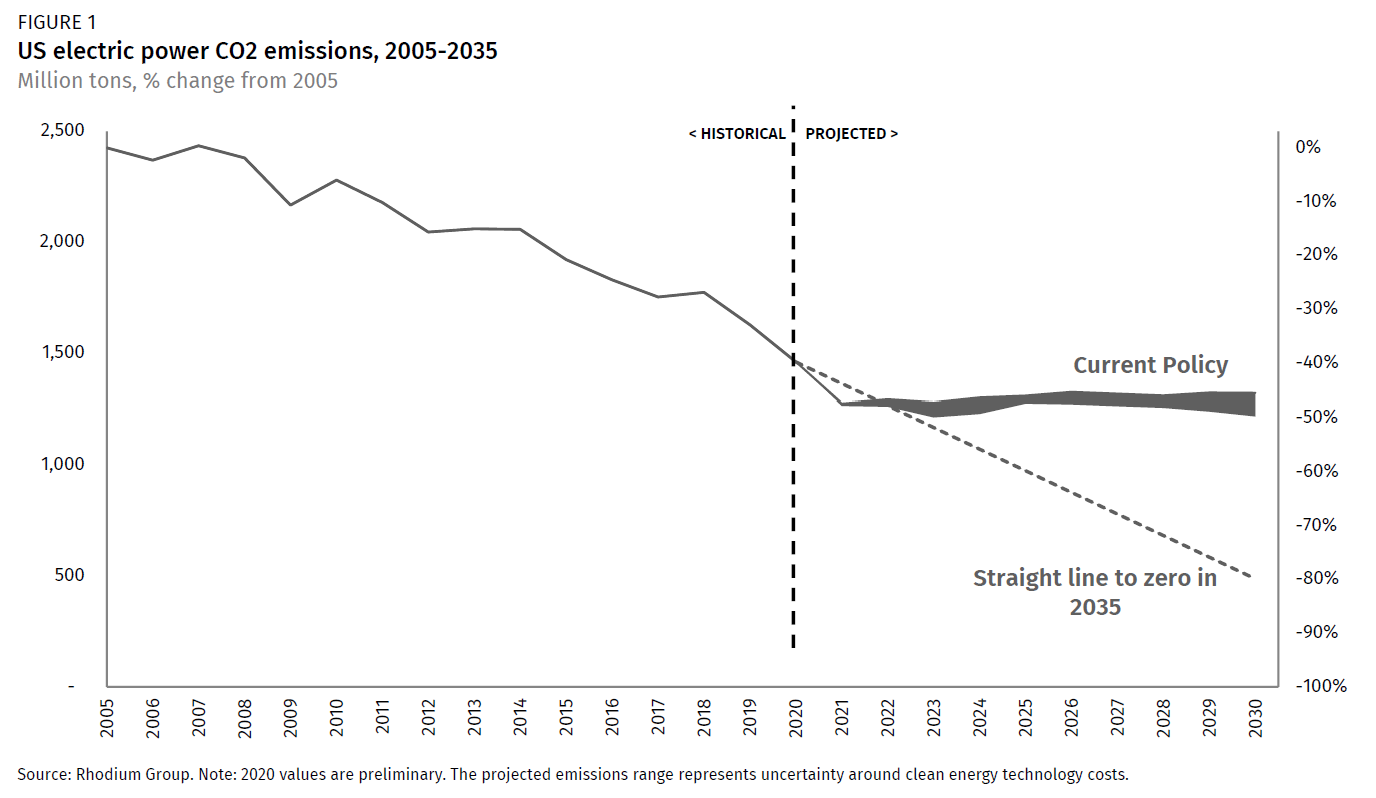

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Varo Mobile Checking No Fees Free Atms Get Paid Early Bank Account Personal Loans Savings Account

Jessejenkins On Twitter It S Out Repeat Project S Analysis Of The Climate Amp Energy Impacts Of The Inflation Reduction Act Nearing A Vote In The Senate At Https T Co 6zdwaadcml The Act Would 1 Cut

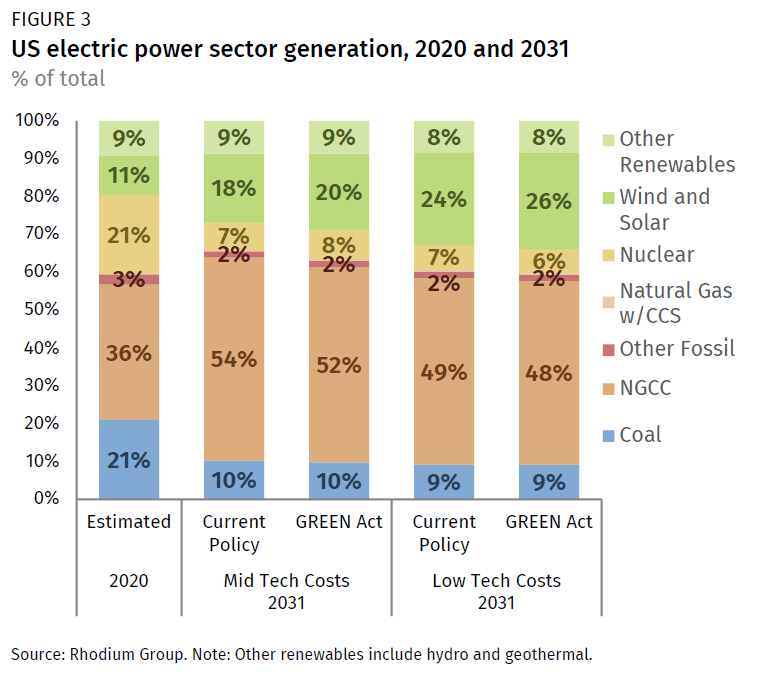

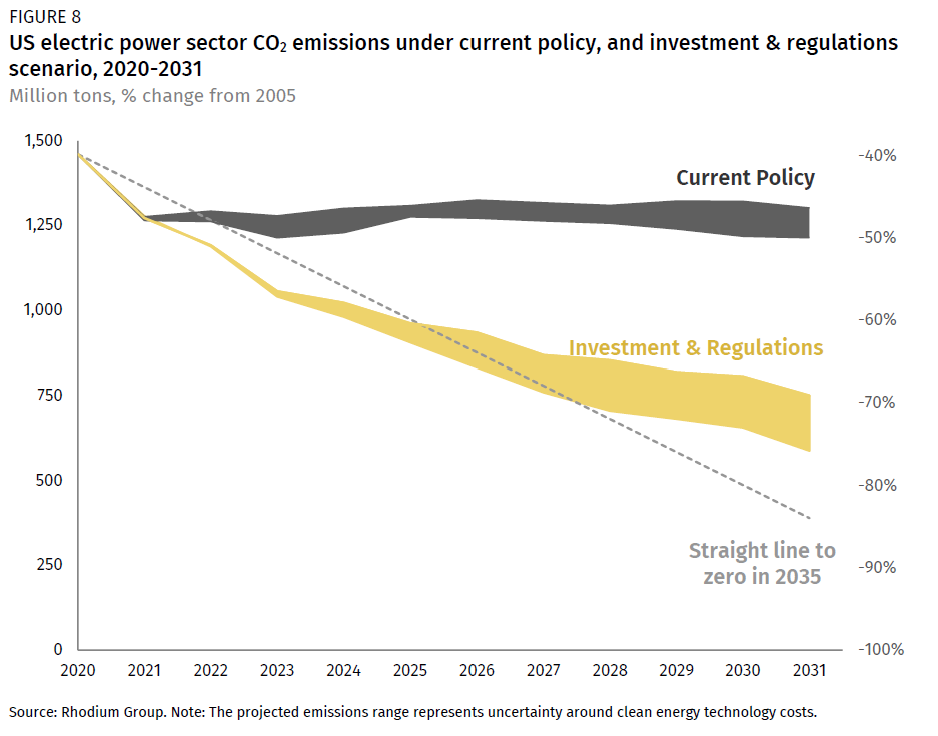

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Biden Budget Biden Tax Increases Details Analysis

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

The Build Back Better Plan Is Dead Now What Forbes Advisor

Signs On Walls How To Work Better Improvised Life Inspirational Quotes Words Cool Words

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Tobacco Taxes Are Win Win Win Tax4health International Health How To Plan World Health Organization

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities